Mileage Rate 2025 Ird Nz. Kilometre rates for business use of vehicles. The tier one rates reflect an overall increase in vehicle running.

The rates set out below apply for the 2025/2025 income year for business motor vehicle expenditure claims. You can use kilometre rates to work out allowable expenses for business of a vehicle.

Sole traders or qualifying close companies can use the kilometer rate method to claim business vehicle costs;

Ird Mileage Rate 2025 Nz Del Gratiana, Make sure you’re claiming the right rate! The 2025/2025 kilometre rates have been published.

Mileage Rate 2025 Ird Ericka Deeanne, To help in calculating an employee’s reimbursement when they use their private vehicle for work. The table of rates for the 2025/2025 income year for motor vehicle expenditure claims.

Free Mileage Log Templates Smartsheet, Use our kilometre rates to calculate the deduction for costs and depreciation. If you are a sole trader or qualifying close company and use the kilometre rate method to claim business vehicle costs, this new rate applies for the 2025 year, being.

New Mileage Rate Method Announced Generate Accounting, Use the new ird kilometre rates as a guide on how much to charge per km. Ird mileage rate 2025 nz.

How to find your Tax code in New Zealand 🇳🇿 YouTube, Use our kilometre rates to calculate the deduction for costs and depreciation. This new rate applies for the 2025 year (i.e., 1 april 2025—31.

Tax rates for the 2025 year of assessment Just One Lap, You can find them on our website. This new rate applies for the 2025 year (i.e., 1 april 2025—31.

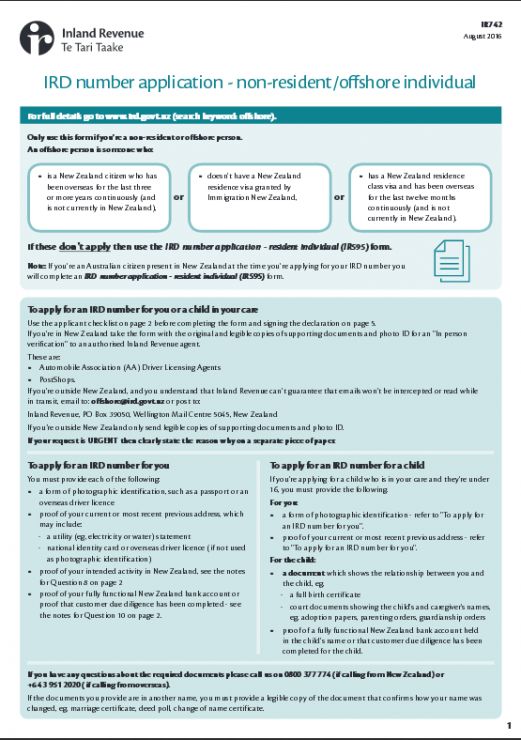

How To Get an IRD Tax Number Inland Revenue New Zealand, Use the new ird kilometre rates as a guide on how much to charge per km. Anyone from ird knows when the 2025 mileage rates come out.

20202024 Form NZ IRD IR880 Fill Online, Printable, Fillable, Blank, Use our kilometre rates to calculate the deduction for costs and depreciation. In accordance with s de 12 (4) the commissioner is required to set and publish kilometre.

The Week in Tax What’s going on with IRD’s business transformation, Make sure you’re claiming the right rate! The 2025 rate for employee use of a personal vehicle is 67 cents per mile.

Ird Mileage Claim Rate 2025 Moll Sydney, This new rate applies for the 2025 year (i.e., 1 april 2025—31. If you are a sole trader or qualifying close company and use the kilometre rate method to claim business vehicle costs, this new rate applies for the 2025 year, being.